How COVID catapulted e-commerce from 2020 to 2030 in just 9 months

Target set a sales record as its same-day fulfillment services grew 273% in the quarter. Both retailers have also invested in online grocery, with Walmart today offering grocery pickup and delivery services, the latter through partners. In Walmart’s case, the pandemic helped drive e-commerce sales up 97% in its last quarter. Target has also just now rolled out grocery pickup and runs delivery through Shipt.

Amazon, naturally, has also benefited from the shift to digital with its recent record quarterly profit and 40% sales growth.

The growth in e-commerce due to the pandemic has set a high bar for what’s now considered baseline growth. In the first quarter of 2020, department store sales and those from other “non-essential” retailers declined by 25%. The shift away from physical stores was already underway, but we’ve now jumped ahead in time as to where we would be if a health crisis had not occurred.

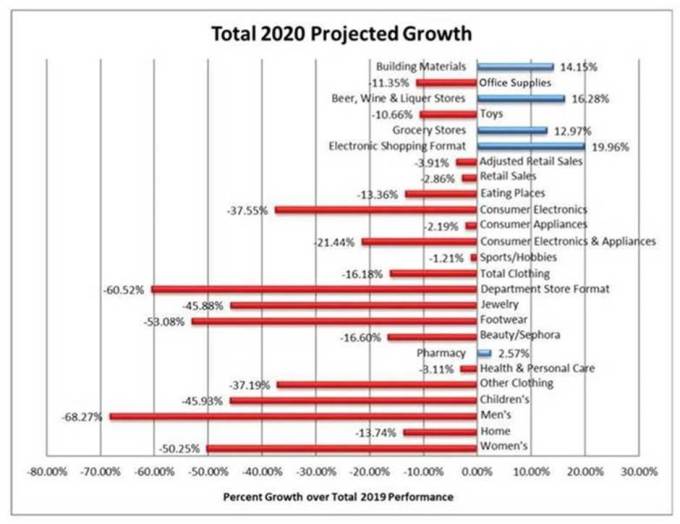

This is a similar trend to what other industries have seen as well, including things like streaming/cord cutting, gaming and social video apps, and more. As the COVID-19 pandemic reshapes our world, more consumers have begun shopping online in greater numbers and frequency. Clothing, for example, declined in importance as more consumers began working and schooling from home, as well as social distancing under government lockdowns. According to new data from IBM’s U.S. However, other categories, including groceries, alcohol and home improvement materials, accelerated, by 12%, 16% and 14%, respectively.

The report suggests that department store retailers will need to more quickly pivot to omnichannel fulfillment capabilities in order to remain competitive in the new environment. E-commerce also accounted for 16.1% of total retail sales in Q2, up from 11.8% in the first quarter of 2020.

The questions that IBM’s report aims to answer is how much of this pandemic-fueled online spending is a temporary shift and to what extent is it impacting longer-term forecasts? The answer, at least in this estimate, is that this pandemic pushed the industry ahead by around five years. Retail Index, the pandemic has accelerated the shift away from physical stores to digital shopping by roughly five years. Meanwhile, e-commerce is projected to grow by nearly 20% in 2020.

The pandemic has also helped refine which categories of goods consumers feel are essential, the study found. Specifically, they will need to drive traffic to their stores through services like buy online and pickup in store (BOPIS), and will need to offer an expanded set of ship-from-store services.

Large retailers like Walmart and Target have embraced omnichannel fulfillment to their advantage. According to the Q2 2020 report from the U.S. Both reported stellar earnings this month thanks to their earlier investments in e-commerce. This grew to a 75% decline in the second quarter.

The report indicates that department stores are expected to decline by over 60% for the full year. Department stores, as a result, are seeing significant declines. Census Bureau, U.S. retail e-commerce reached $211.5 billion, up 31.8% from the first quarter, and 44.5% year-over-year.

How COVID catapulted e-commerce from 2020 to 2030 in just 9 months Read More »